If you’re in the US Military or you’re in a military family, you’re probably eligible to bank with USAA Bank. The question is, should you?

Anyone familiar with USAA auto insurance might immediately think, “hell yeah.” That’s because USAA auto insurance is pretty awesome, offering rock-bottom rates, superb customer service, and military-specific perks and discounts.

So is USAA Bank as desirable as its insurance arm? What specific perks can they offer military personnel? What products do they offer, and how are their interest rates these days?

Let’s investigate USAA Bank.

What Is USAA Bank?

USAA stands for United Services Automobile Association. In the early 20th century, insurance companies perceived military personnel as innately higher risk and charged them out the wazoo for insurance. So in 1922, 25 military officers launched USAA with the goal of providing military folks and their families an affordable coverage option.

Since then, USAA has exploded into a Fortune 500 financial institution offering insurance, banking, investing, and other options to nearly 13 million military members and their families nationwide.

Today, USAA Bank offers its members a variety of account types like checking, savings, and CDs, plus affordable loan options for cars, boats, and RVs.

USAA Bank Pros & Cons

Pros

- Wide variety of account options — Unlike some modern online-only banks, USAA Bank offers the complete suite of checking, savings, and investment accounts.

- 60,000+ ATMs with fee reimbursement — USAA’s policy towards ATMs is pretty unbeatable; they never charge their own fees for the first 10 withdrawals from over 60,000 ATMs, and will even comp up to $15 of the other bank’s fees.

- Highly rated mobile app — The USAA Mobile app scores above 4.5 stars in both app stores for being comprehensive and easy to use.

- Above-average customer service — USAA Bank and USAA in general is known for taking care of military families. If you’d like your bank not to end up in headlines for the wrong reasons, USAA Bank is a safe choice.

- Great rates on auto loans — USAA Bank offers rates as low as 3.69% on auto loans, which is near the lowest you’ll find anywhere.

Cons

- Restricted to military personnel and their families — Unfortunately for civvies like me, USAA Bank is restricted to active and retired military personnel and certain family members.

- Only 4 physical locations — USAA is pretty much an online-only bank, so if you value being able to chat with the teller you might want to bank with the guys down the street.

- You can find higher APYs elsewhere — As of August 2022, USAA Bank’s interest rates on savings accounts and CDs just aren’t that impressive. If your primary goal is to maximize your investments, you’ll want to shop elsewhere.

Who Qualifies for USAA Bank?

USAA Bank (and all USAA products) is open to anyone with a USAA Membership. Generally speaking, that’s US Military personnel and their families. More specifically, that includes:

- Active, retired, and separated veterans with a discharge type of “Honorable”

- Spouses, widows, widowers, and unremarried former spouses of USAA members

- Children and step-children of USAA members

However, the following groups are not eligible for USAA membership:

- Parents of USAA members

- Siblings of USAA members

- Grandchildren of USAA members (if their parents were not members)

If you just learned that you’re probably eligible for a USAA membership, I’d strongly recommend you take advantage. Even if you don’t bank or insure with USAA, a vanilla USAA membership is free and includes a host of lifetime benefits like sweeping discounts and complimentary financial advice.

How Does USAA Bank Work?

Naturally, the first step to setting up accounts with USAA Bank is to get a USAA Membership. You’ll need the following things handy:

- Your date of birth, contact information, and Social Security number

- Details about you or your family member’s military service

- For non-U.S. citizens, a passport or permanent resident card

Once you’re approved for USAA, you can apply to open an account with USAA Bank.

To start, the bank will ask you to open a checking account with a minimum $25 deposit. You have two options: USAA Cashback Rewards Checking or USAA Classic Checking.

I’ll go over the details of each in the sections below, but in short, USAA Cashback Rewards Checking prioritizes rewards points, while USAA Classic Checking grants a trickle of interest plus reimbursement for out-of-network ATM fees.

Once you open a checking account, you can head to your online dashboard to open one of USAA’s additional account types, including a USAA Performance First savings account, a CD, and more.

If USAA Bank were an actor, it would be Betty White. Born in 1922, but hip and modern enough to host SNL with Jay-Z. Case in point, USAA Bank’s online dashboard and mobile app are both easy to navigate and effortless to use. They certainly haven’t let their reputation for supporting aging veterans hold them back from offering state-of-the-art banking tech.

Lastly, if you need to reach out to USAA’s strong customer service department, you can do so via instant messaging through the app or by calling them up the old-fashioned way. USAA is known for taking care of its people, so you shouldn’t hesitate to ask for assistance.

How Much Does USAA Bank Cost?

True to their roots, USAA Bank is not out to squeeze money out of military folks, but rather, make their lives easier.

So naturally, in the rare case USAA Bank even charges a fee, it’s usually well below the industry average.

USAA Bank requires a $25 initial deposit for a checking account, but after that, there are no monthly service fees or account closing fees. Plus, having skimmed their fee schedule for all account types, I couldn’t find any surprise “gotcha” fees.

Services like overdraft protection and rejected debit card purchases (where other banks like to nickel-and-dime folks) are totally free.

On the topic of overdrafts, USAA Bank charges $0 for overdraft protection on all account types and, blessedly, $0 for extended overdrafts, i.e., a daily charge as long as your account is overdrawn. This is a bigger deal than it sounds because extended overdraft fees are a pretty malicious way some banks keep account holders in debt.

Read more: Understanding Overdraft Protection and Fees

Features of USAA Bank

On the whole, what features and account types does USAA Bank offer?

USAA Classic Checking

USAA’s main personal checking account is called USAA Classic Checking. Here are the highlights:

- Direct deposit

- Access to over 60,000 ATMs in their preferred network nationwide (plus, if you have to use another ATM, USAA will refund up to $15 in fees per cycle)

- Zero Liability for unapproved charges on your debit card

- Mobile deposits

- Compatible with Zelle, Apple Pay, Google Pay, and Samsung Pay

- Generate 0.01% APY with a daily balance of $1,000 or more

- $25 minimum initial deposit required to open

It’s mostly standard stuff, although two things stand out to me.

First, the incredible ATM access. I’ll expand more in a later section, but 60,000 is not a small number. For context, there are just 40,000 McDonald’s locations worldwide.

Second is that 0.01% APY. Most checking accounts don’t generate interest — quite the opposite, they pepper you with fees throughout the year. But the USAA Classic Checking account generates a steady 0.01% APY on your balance. Sure, it’s only $1 for every $10,000 you have in your account, but it’s still a nice reminder that USAA isn’t trying to take from you, but give instead.

USAA Personal Loans

Personal loans are general purpose loans to cover things like home renovations, weddings, or medical emergencies.

So how does USAA stack up?

As of August 2022, just OK. The bank doesn’t publish its rates front and center, but if you tinker with its personal loan calculator long enough, you’ll see a range of 7.69% to 8.69% APR start to appear.

Historically, 7.69% for a personal loan isn’t bad. But there are so many competitors in the lending space these days that rates have dropped as low as 3.99%.

Considering the convenience and customer service USAA offers, I’d say that it’s worth keeping them on the short list as you shop around for personal loans. But rates are king, so don’t hesitate to take 3.99% if it’s offered!

Read more: Best Personal Loans

USAA Mortgages

USAA’s mortgage rates are in the 5% to 7% range, which is pretty standard for the current market.

And one thing’s for sure. USAA is an excellent choice for VA loans. They know VA loans like Salt Bae knows steak, and are widely considered one of the best lenders in the country for securing one.

USAA also offers conventional home loans, vacation home loans, and a variety of down payment options. Simply put, they’re seasoned experts at putting servicemembers and their families in houses, and if you’re both a qualified borrower and a USAA member, they’re worth a spot on your short list of mortgage lenders to consider.

Still, you’ll always want to get multiple quotes before committing to a mortgage lender. Check out our list of the best mortgage rates, updated daily.

USAA Bank Credit Cards

USAA Bank currently offers five credit card options. Here’s a list, and what they’re best for:

- USAA Rewards™ American Express® Card: Best for dining and groceries

- USAA Rewards™ Visa Signature® Card: Best for dining on a Visa

- Cashback Rewards Plus American Express® Card: Best for gas and on-base purchases

- Preferred Cash Rewards Visa Signature® Card: Best for rewards on all purchases

- USAA Rate Advantage Visa Platinum® Card: Best for a low-interest rate

It’s worth mentioning that none of USAA’s cards have an annual fee or penalty APR, and each includes a host of travel and retail perks on top of your USAA membership benefits.

Vast ATM Network and Fee Reimbursement

USAA Bank may only have four brick-and-mortar locations, but its network of free ATMs is vast: over 60,000 in their preferred network (including PNC Bank and other logos). Even if you can’t find a USAA-friendly ATM nearby, remember that USAA won’t charge fees on their end for your first 10 monthly withdrawals.

Plus, if you have a USAA Classic Checking account, they’ll cover the other bank’s fees for up to $15 monthly. That’s a pretty sweet perk because it expands USAA’s network of “free” ATMs to 3.5 million.

USAA Savings, Performance First, and Youth Savings Accounts

USAA Bank offers three savings account types: regular Savings, Performance First, and a Youth Savings account.

All three accounts offer the following features and benefits:

- No monthly service fees

- No minimum balance required

- Mobile check deposits

- 24/7 fraud protection

- Automatic transfers

- Goal planner and tracker

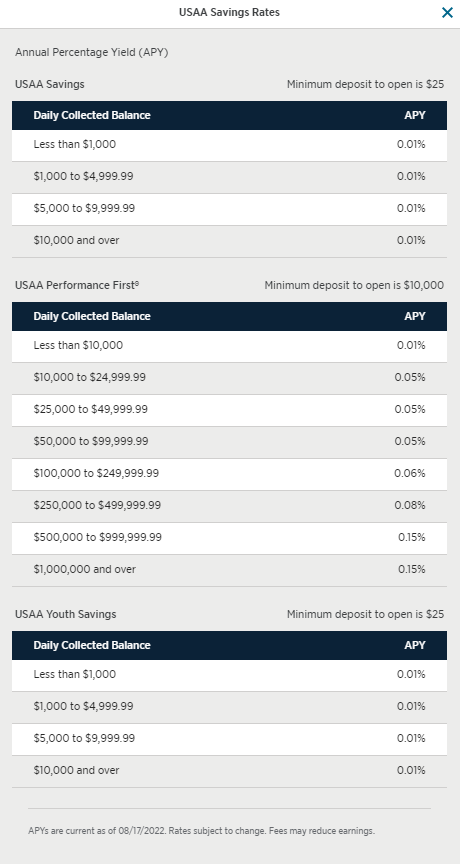

The differences between the Savings and Performance First accounts are pretty clear-cut. The USAA Savings Account requires just $25 to get started, whereas the USAA Performance First Savings Account requires $10,000 and offers higher interest rates in return.

Finally, the Youth Savings Account operates like a regular Savings account but with the added ability to grant your child limited access when they turn 13.

Here are the interest rates for all three accounts with varying balances:

USAA Bank CDs

A CD, or Certificate of Deposit, is like a savings account with a fixed term and fixed interest rate. Knowing both terms upfront can help you plan your financial future with more accuracy than a traditional savings account with variable interest.

USAA Bank offers a pretty impressive array of 16 CD terms ranging from as little as 30 days to 7 years. Most banks only offer around five. Plus, the minimum deposit for CDs is just $1,000, which is lower than some other banks (though others go as low as $500).

Plus, USAA’s CD rates are pretty good. They don’t vary by deposit amount — a four-year Standard ($1,000) will generate the same APY as a Jumbo ($95,000+) — so you don’t have to worry about locking up too much money to maximize your rates.

The rates in question range from 1.16% APY to 1.76% APY at the time of this writing (you can always check the latest rates here).

Read more: Best CD Rates

USAA Investment Accounts with Strategic Partners

It’s worth a quick mention that USAA Bank doesn’t offer investment accounts (Roth, 529, etc.). Rather, USAA redirects you to “strategic partners” Charles Schwab and Victory Capital to open such accounts with them.

At first glance, neither broker seems to offer any clear USAA-exclusive benefits. Victory Capital mentions USAA Mutual Funds and the USAA 529 Education Savings Plan, but it’s unclear how these products vary from the products Victory Capital offers all of its investors.

USAA Auto Loans

USAA offers compelling, below-average rates on auto loans, with APRs as low as 3.69% on new cars and 4.34% on used cars. You can always check the latest rates here.

These rates are solid, but you may still be able to go lower with another lender. According to Experian, borrowers with Super Prime credit (781+) got average loans of 2.40% on new cars and 3.71% on used cars.

Read more: Best Auto Loans – Where to Find the Best Rates

That being said, USAA’s legendary customer service may make up for the small gap in rates you may find.

The USAA Bank Mobile App

I already blessed the USAA Bank mobile app with a Betty White analogy, but it’s worth a second mention. These days, most banks are able to offer a full dashboard of tools in their mobile banking app, from check deposits to account monitoring. What makes one stand out, then, is ease-of-use and optimization.

Most folks aren’t quick to praise a mobile banking app on the app store, and yet, the USAA Mobile app scores 4.3 stars and 4.8 stars on Play Store and App Store, respectively, from nearly two million combined user ratings.

Judging by the reviews, folks just seem to be happy with the app’s comprehensiveness and ease-of-use. There’s virtually no feature that USAA customers struggle to use or find. Considering the age spread of USAA’s account holders, that’s no small feat.

USAA Bank Customer Service

USAA Bank’s customer service team deserves a shoutout. The bank maintains a strong 3.8 stars on ConsumerAffairs out of 493 reviews, and although they’ve been pummeled on BBB, they’ve taken the time to carefully respond to each critical review.

Part of why folks generally appreciate the customer service team is their availability. That’s a level of dedication I often see from medium-sized insurance companies but not Fortune 500 banks.

It’s a small thing, but I appreciate how USAA Bank doesn’t bury their customer service phone number in a sea of menus and FAQ pages. You could argue that they’re just trying to help, but I don’t like having to solve the Hellraiser puzzle every time I call my bank. So for USAA Bank to say, “Wanna call us? Call us” is admirable.

USAA Insurance

Although this review is focused on USAA Bank, the company’s insurance arm deserves a quick shoutout, too. Rates for auto, home, and life insurance tend to be lower across the board, and the USAA policyholders I spoke to all felt “well taken care of” by the company’s customer service team during the claims process.

That being said, you’re not required to bank with USAA to purchase a policy and vice versa.

My Personal Impressions of USAA Bank

Having researched USAA Bank extensively, pouring through terms and conditions, and reading customer reviews, I get the following impression: I won’t make the most money with USAA Bank, but I’ll be taken care of.

I won’t name names, but there are banks out there I wouldn’t trust with my lunch money, never mind my life savings. I get the feeling that some banks feel that the customer exists to serve them, and not the other way around. I get the sense USAA feels the opposite and has stuck with its founding principles for a century.

My buddies in the military validated my feelings. Sure, there’s an extra ~0.25% to 0.50% APY to make elsewhere, but other banks may not have their backs or understand the challenges and idiosyncrasies of being in the military.

For servicemembers (and their families) seeking a VA loan, a sturdy checking account, and a variety of loan options (if not always rock bottom rates), USAA is an obvious choice.

Who Is USAA Bank Best For?

Military Personnel and Their Families

Not really “best for” per se, but USAA Bank is only for active and retired military personnel and their families. You need a full USAA membership to qualify.

Anyone Who Values ATM Access

Perhaps you run a cash business or just like having Benjamin in your back pocket. If you frequently visit the ATM, you should strongly consider USAA Bank for its impressive ATM access alone.

There’s no ATM fee for the first 10 withdrawals per monthly statement cycle when you use an ATM in the preferred network. And with a USAA Classic Checking Account, they’ll waive $15 of other banks’ fees monthly.

However, it’s important to note that for withdrawals made at some non-USAA ATMs in the network, USAA charges $2 per withdrawal after your monthly 10 transaction limit.

Anyone Who Prioritizes Customer Service Over APY

USAA Bank isn’t the best for overall returns, but they take darn good care of military folks and their families. They exist to serve you, not the other way around.

Who Is USAA Bank Not Ideal For?

Non-USAA Members

Put simply, if you don’t qualify for USAA membership, you’re not eligible to bank with USAA. Sorry!

Savers Seeking Maximum Returns

USAA’s rates simply aren’t competitive with the overall marketplace. For an account balance of $50,000 their savings caps at 0.25% and CDs at 0.43% for seven years. Competitors can offer up to 0.50% and 1.00% on each account type, respectively.

Small Business Owners

A lot of military or military-affiliated folks run small businesses, so it’s a strange oversight that USAA Bank doesn’t offer business checking accounts.

If that’s you, you’ll need to bank elsewhere; you don’t want your business payments routing to your personal USAA Bank checking account lest you incur massive self-employment taxes (and other inconveniences).

Read more: Best Banks For Small Businesses

Summary

I’ve picked on USAA Bank for not offering top-shelf APYs like its competitors, but in reality, a ~0.25% difference in APY may only amount to around $100 per year. Depending on what you want from your bank, that might be a small price to pay for trustworthiness and above-average customer support.

Plus, USAA Bank has a lot else going for it — virtually limitless ATM access, a superb mobile app, and competitive rates on auto loans, to name a few.

So if you’re a USAA member who doesn’t mind giving up physical branches and maximum APY, USAA Bank might be your next bank.

Read more:

- Tips for Saving Money in the Military

- Best Credit Cards for Military Members