When you arrive to work for your first day of a new job, the stack of onboarding paperwork can be a bit intimidating. As you sift through your paperwork, which might be completed online, one of the most important places to look first is your direct deposit payroll information.

While benefits like health insurance, life insurance, and other parts of your compensation package are just as important in the long-run, getting payroll setup first is a smart idea. That’s how you get paid, after all.

Here are the key steps to set up a direct deposit to a checking account for your new job.

Find your payroll direct deposit form

To set up direct deposit, it is important to first make sure that you have a basic checking account. If not, you can find free checking accounts with no minimum deposits online.

The next step in setting up your direct deposit is finding the place to enter your direct deposit details. In the many jobs I’ve had over the years, I’ve seen both paper and digital direct deposit forms. Larger companies tend to give you the ability to manage your direct deposit account yourself through the company’s HR website. Smaller ones might use paper forms.

In either case, you have to find that form. If you are not sure where to look, ask your manager, a veteran coworker on your team, or someone from human resources. They will be able to help you locate the form and get one step closer to getting paid!

Locate your account number and routing number

Your payroll forms are going to ask for details about your bank, which may include the bank’s name, address, and phone number. You’ll also be asked for your routing number and account number.

The 10-digit routing number tells the Federal Reserve’s payment clearing system which bank to route a payment to or from. The account number is your unique checking account number assigned by the bank.

Here’s where to find your account number and routing number for your checking account:

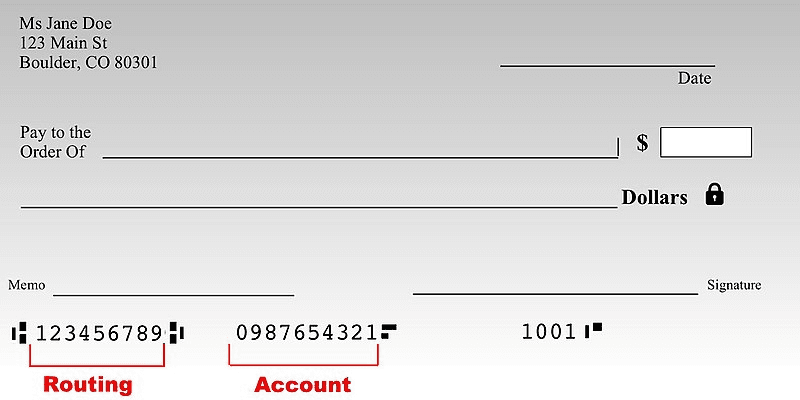

Finding your account number and routing number on a check

This example check shows the location of the routing and account number at the bottom of a check.

If you have a checkbook for your account, grab it and open up to the next blank check. Look at the bottom left for the routing number and account number.

Fun fact: The routing, account, and check number are printed in a special metallic ink that can be read by a Magnetic Ink Character Recognition (MICR) machine. Share this fun fact to impress friends or family at your next dinner party.

Finding your account number and routing number on your bank’s website

Some checking accounts don’t have paper checkbooks anymore. If you don’t have a checkbook or don’t have it handy, you can still find your routing and account number on most bank websites. If not, call your bank’s customer service line during your lunch break to get your account details for direct deposit.

Generally, you can find routing and account details through the account details or customer service page on your bank’s website. Keep in mind that some large banks could have multiple routing numbers, so you will want to look carefully to make sure that you get the right one. It’s important that you get it right or someone else could get your paycheck!

Enter your account details and check them twice

Back in school when you had extra time at the end of a math quiz or test, it was probably a good idea to go back and check your work to make sure you didn’t make any careless mistakes (even though no one ever did it). That is an essential step when it comes to direct deposit forms. If you make a mistake, you might not receive your paycheck (this is way more important than that math test).

Double-check the routing number and account number twice to be safe. If you’re confident everything is correct, submit your form. As long as you do your job, you should get paid automatically by direct deposit every payday.

Bonus tip: split your direct deposit to boost your automatic savings

Did you know your employer might be able to split your direct deposit into two different accounts? If your employer offers this option, you can automate your saving and investments without ever seeing the money in your checking account.

For example, you could contribute $20 per pay period to an emergency fund, $200 per paycheck to a Roth IRA, or 2% of your paycheck to your savings account for a down payment on a home or car.

There’s no limit to the ways you can funnel money into savings and investment goals beyond the limits of your employer’s payroll service. If you can split your paycheck into two or three accounts, it could be a great way to build a savings habit without even thinking about it.

Summary

Getting a new job is exciting, but you won’t want to forget about the paperwork! When filling it out, pay extra attention to your direct deposit form and ensure that you are filling it out correctly. If not, you could find yourself needing to cash a paper check come payday.

But if you want to further your financial goals, like investing and saving, you can split your direct deposit between different accounts!