Checkbooks might seem obsolete in this day and age. As digital payments become more common, it’s easy to maintain a checking account without ever writing a check.

But paper checks can still be a good tool for money management and security. If you want a non-digital method of payment that’s more versatile than cash, checks are still your best bet.

Do you still need a checkbook?

The short answer: not really. Most transactions allow or prefer other forms of payment. There are some exceptions—landlords may want tenants to pay rent with checks, for example. But these instances are pretty rare nowadays.

Think of checkbooks as a helpful supplement, not a necessity. Writing checks can be part of a more “hands-on” approach to financial planning.

Checkbook maintenance tends to take more effort than digital transactions; while it’s easy to set up an automatic payment online and forget about it, a check-writing routine will remind you of where your money is going.

How do checks work?

They’re instructions for you bank

A check is a written set of instructions for your bank, telling them to transfer a certain amount of money from one account to another.

The speed of this transfer depends on the transaction. A check written to a business should be processed electronically and quickly, often within 24 hours. A check written to a friend will be processed as soon as the friend cashes it.

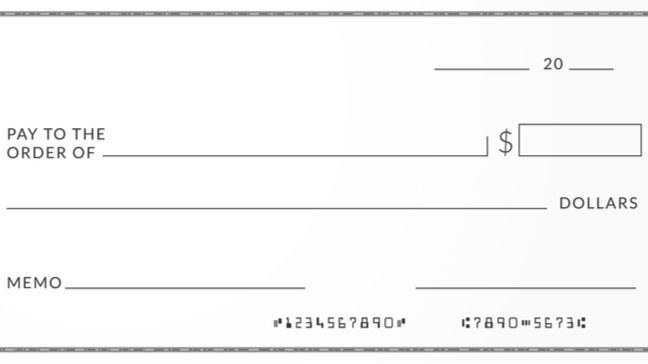

Routing, account, and check identifier numbers

Checks come with three numbers on the bottom—two long numbers and one shorter number. The first one is your routing number, which identifies your bank or credit union to let recipients know where to “route” the money. The second one is your account number, which identifies your specific account.

The third (shorter) number is a four-digit check identifier that is different for each check. Usually you’ll get numbered checks in a sequence. Though you don’t have to write them in numerical order, most people do to avoid confusion.

A few guidelines for check writing

- If you don’t have the money, don’t write the check. Funds get deducted as soon as the check is processed.

- Write out the amount of money in words. Add a “cap” at the end so the recipient can’t rewrite and add money. A check for $75.50, for instance, could be written as seventy-five and 50/100. A check for $75 could be written as seventy-five even.

- Don’t forget to sign your name. Checks can’t be processed without a signature.

- Record your transactions as they happen. Checkbooks will come with a blank chart or register for you to write down when, where, and how much you spent. Recording the details of each check will help you when it comes time to balance the checkbook. You can keep a record any way you want—the checkbook register, a secure online app, an Excel spreadsheet, or anything you’ll remember to use.

When are checks useful?

When you don’t want extra fees

Some businesses charge convenience or processing fees for credit and debit card payments. Utility companies and government agencies often do this, for instance. The fees may even cancel out any rewards points you earn for using the card.

Check payments, which don’t require fees, can help you avoid racking up those hidden costs.

When you want a paper trail

A major benefit to checks is how traceable they are. They become easily located records of your spending.

Banks will scan a check digitally once it’s processed, so you can find a copy in your online bank account or refer to the carbon copy in your checkbook. These copies come in especially handy if there’s any miscommunication or dispute. And since checks are dated, you have an easy record of the date you made a payment.

When the Internet is down

It’s rare, but it does happen — you might lose Internet access when you need to transfer some funds. Checks are a pretty failsafe method if you can’t cover the amount in cash.

Are there any downsides to using checks?

They pose a security risk

Checkbooks come with your bank number on them. There may be other secure info on there, too, like your address or phone number.

If a checkbook is lost or stolen, the process of minimizing damage can get pretty complicated. You’ll likely want to close your checking account and open a new one.

And banks often charge fees if you need to stop a check, while they won’t do so for a debit card.

There can be delays in processing

Checks once had a longer “float” period between the time you wrote the check and the time it was processed. These days, banks process checks pretty rapidly, but some lag time is still possible.

Delays can get confusing, possibly making you lose track of how much is in your account at a given time.

An error can throw off your balance

If you forget or miscalculate an entry in your checkbook register, you may think you have more money than you actually do. This could result in returned check fees, overdraft fees, or a bounced check.

Checks (usually) aren’t free

Some banks and credit unions do offer free checks, especially if you only need a few. But a box or book of checks might come with a charge as high as $35.

How do you keep checks secure?

No payment method has 100 percent guaranteed security. But there are always ways to lower the risk of theft.

Your bank info will be on the check no matter what. But the only other personal information you need to add is your name. You don’t have to put your home address on checks. Other info, like a phone number or drivers’ license number, should only be added if the recipient requires it.

If you’re mailing a check, use a secure envelope designed to keep anyone from reading the text inside. Drop it in a post office box instead of leaving it in an unlocked mailbox.

Keep checks in a secure spot at home. Some users recommend writing down the lowest and highest check numbers in your checkbook just to keep track.

And look at transactions—not just your overall bank account, but your check transactions—on a regular basis to see if anything is amiss.

Where do you get checks?

The easiest spot is your bank or credit union. But if they charge a high fee for checks, you can order (equally valid) checks online through a third party printer. These tend to be much cheaper, particularly if you plan to use a lot of checks.

A legit check printer will be approved by the Check Payment Systems Association. You can tell by looking on the right side of a check (under the “amount” space) for a lock or padlock icon. This signifies the check meets basic security standards. Search for any printer you plan to use on the Better Business Bureau to make sure they’re above board.

How do you balance a checkbook?

If you use checks semi-regularly you’ll want to get into the habit of balancing your checkbook. This is the best way to make sure your record of transactions matches your bank statement. You can spot any discrepancies, alert your bank to possible fraud, and get a better idea of where your finances stand.

Monthly balancing (at least) is generally recommended. You’ll need:

- Your bank statement

- Your record of check transactions (checkbook register or other method)

- A calculator (most phones have a calculator function)

Step 1. Check the balance on your bank statement

Go to your bank account(s) and write down the amount (or amounts if you have multiple checking accounts).

Step 2. Compare your personal check register to your bank statement

Bank statements include all your transactions—cash withdrawals, debit card purchases, direct deposits, etc. It’s helpful to enter each of these transactions in your checkbook register so you have a running total and can add everything up at month’s end.

If you’re only recording check transactions, you can still compare your recorded checks to the check withdrawals on your statement.

Either way, do the math to make sure the bank’s total is the same as yours.

Step 3. Highlight anything that doesn’t add up.

This might be a matter of timing – for instance, if you just sent a payment and the recipient hasn’t yet withdrawn the funds. Or you may have written down an incorrect amount in your register.

If you spot a charge on your statement you don’t recognize, or a clear overcharging error, let your bank or credit union know as soon as possible.

Step 4. Draw a line in your check register.

The line lets you know where you finished balancing, so you can pick up where you left off next month.

Once you balance the checkbook a few times, the process should come naturally. A checkbook probably won’t be your primary method of payment, but it can be an important financial tool in a well-rounded toolbox.

If you’re a visual learner, here’s a helpful video on balancing your checkbook:

Summary

Checks are no longer necessities, but they can be convenient. Your landlord may prefer checks, or maybe you want to easily track your transactions – checks allow you to do this, too.

Either way, it’s still important to know how to write a check and balance your checkbook.