Empower is known for paid wealth management services, but there’s also a 100% free Empower Personal Dashboard™ that can link to your accounts and track your financial profile, breaking down cash flow, net worth and allocation in your portfolio with easy-to-read visuals. Plus, the Empower app has a number of free comprehensive tools and calculators, including one of the best retirement planners we’ve come across.

With over 500 financial service reviews published since 2006, our editorial team has decades of experience researching the best personal finance products. When evaluating financial apps, like wealth management from Empower, we look at variety of tools, relevant fees if any may apply, what level of investor may appreciate use, and competitors who may be offering more or less.

Empower is a hybrid digital wealth management company and powerful finance app. In addition to paid investment management and advisory services, Empower offers a number of free tools and calculators to help with everything from net worth tracking to saving and retirement planning.

- Easy-to-use app provides financial 'big picture'

- Tools and calculators are completely free to use

- Great security, including two-factor authentication

- Wealth management fees can be be high

- May be subject to upsells

What is Empower?

Empower, formerly Personal Capital, was founded in 2009 by Bill Harris, a fintech expert with past experience working for PayPal, Intuit, and more. He created Empower to offer everyday investors a modern and affordable way to manage their investments and get advice.

In 2020, Empower Retirement acquired Personal Capital, and the two platforms combined strengths to deliver a more comprehensive and personalized investment management and retirement planning solution.

Today it’s one of the biggest retirement plan providers in the nation. Empower controls more than $1 trillion in assets under administration and serves over 17 million customers in partnership with Empower.

Empower pros & cons

Pros

- Easy-to-use app — The Empower app is user-friendly and intuitive, with helpful well-displayed visuals to represent the “big picture” of your money.

- Great security — Empower has two-factor authentication. So whenever you log in from an unknown device, you’ll get a text message or phone call with a PIN that you must enter along with your password.

- The app is free — While you do have to pay some fees if you have Empower financial advisors manage your money, the app with dashboard and powerful tools are completely free to use.

Cons

- Wealth management fees — Empower requires some hefty fees for its wealth management services. But in our opinion, they’re worth it.

- Upsells — Empower may reach out to its users to try and sell its wealth management service, commonly after users reach balances of $100,000.

Empower features

Empower offers a variety of features to help you better manage your investments, track your portfolio’s performance, understand your cash flow, avoid hidden fees, and more.

You can use it to meet your investing goals by taking advantage of the many retirement planning tools and portfolio optimization features and calculators. But although Empower stands out as an investment app, it can also help you save and budget.

Here are some of the free financial tools available to all users who sign up for the Empower app.

Portfolio analysis

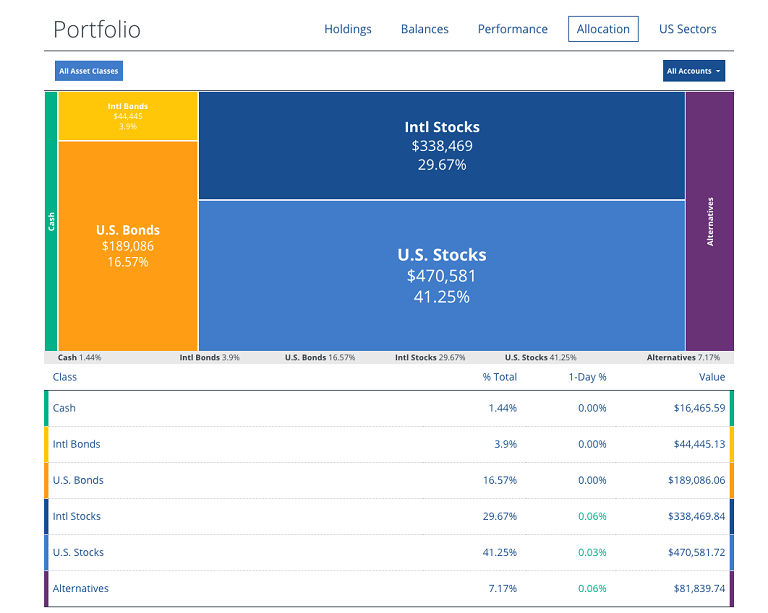

In the allocation investment checkup tool, the colored rectangles show the percentage of your portfolio in each asset class: Cash, international stocks and bonds, US individual stocks or bonds, and alternatives.

Empower lets you explore your entire investment portfolio visually, regardless of where you hold the investment assets (Fidelity, Robinhood, your 401k, etc.). I’ve found this valuable for managing my own overall asset allocation.

For example, in the recent stock market rally, the percentage of stocks I own compared to bonds has ballooned. Empower lets me see just how much and identify the accounts in which I should sell some stocks and pick up alternative assets. Of course, that’s a basic example – Empower can break down your portfolio by industry, market cap, and a host of other variables that even the most experienced investors looking for one of the best portfolio trackers can benefit from.

Net worth and cash flow tracking

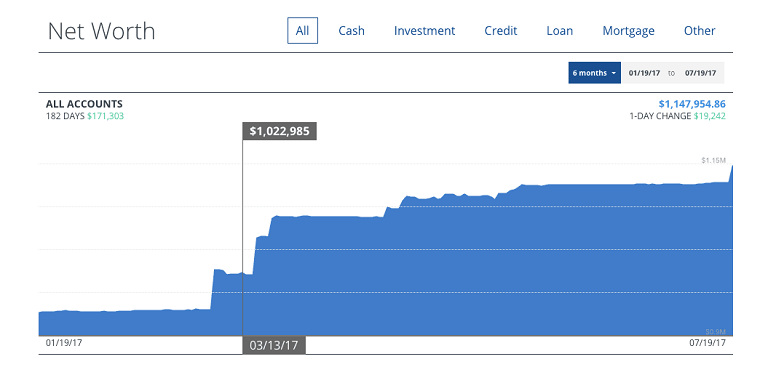

What good is a financial app if it doesn’t provide a clear summary of your financial position?

The Empower net worth report puts your balances, cash flow, and investment holdings in one place. It also integrates with the real estate website Zillow to provide daily updates on your property values.

Empower also includes a full-featured “personal finance manager” (similar to budgeting app, Mint) that automatically aggregates your income and expenses, then displays your cash flow data in easy-to-read charts.

Both of these features combine to give you a deeper understanding of where your money is going and what you’re working toward.

Retirement planner

With the retirement planner from Empower, you can see if you’re on track to retire when you plan to.

You can input different variables, like different incomes and events, to see how changes to your cash flow may impact your retirement date and your total cost to retire. For example, putting a child through college or collecting Social Security. This lets you create a spending plan with a data-driven feature to find out just how much you’ll be able to afford each month.

The ability to run different scenarios even lets you simulate events, like a recession. This lets you see how your retirement plan would have been impacted by a market event like the Dotcom crash or 2008 financial crisis.

This comprehensive dashboard is one of our favorite tools from Empower and we’ve found you’ll get the most out of it if you revisit it often.

Calculators

There are many different calculators that all users can use for free. To name just a few:

- Monthly budget calculator

- Emergency savings calculator

- College savings calculator

- Life insurance calculator

- Debt payoff calculator

- Debt vs investment calculator

- Roth conversion analyzer

- Investment calculator

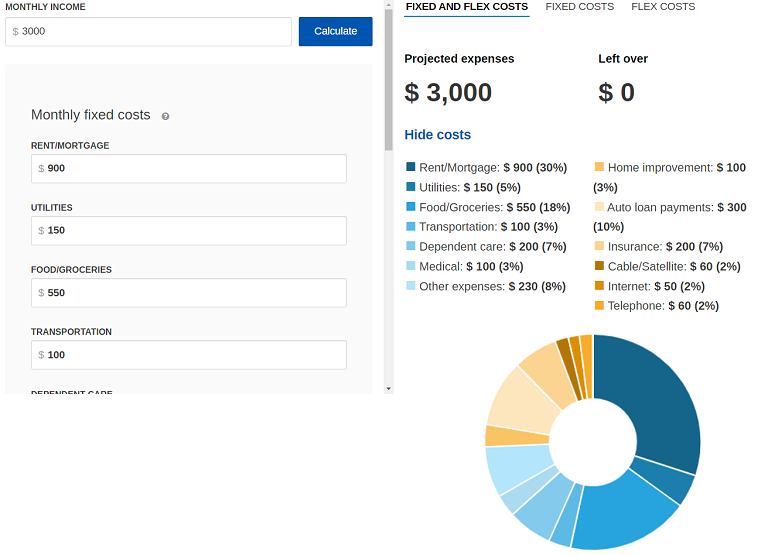

The monthly budget calculator rivals some of the other best budgeting apps, like YNAB and PocketSmith. It’s a great tool for creating a monthly budget and checking your progress. It can help you calculate your fixed and variable expenses, track your spending, and set goals for how you want to use your money.

The more accounts you link, the clearer your spending habits will be so you’ll be able to identify future areas for additional savings.

Savings planner

The free Savings Planner covers four key areas:

- Retirement savings – tells you what you need to save for a 70% chance of meeting your retirement goals.

- Emergency fund saving – calculates how much money you need to cover three to six months’ living expenses in an emergency fund.

- Debt paydown – shows all the money you owe, like on your credit card, in one place so you can track progress.

- Account level savings – only for paid clients, this provides personalized recommendations optimized to help grow your savings faster.

You may find you want more help with a large savings goal such as saving for college. For additional support, financial advisors from their paid wealth management service are available to discuss the methods you can use to fund education expenses. Their goal is to help make sure you’re saving and paying for college in the most tax-efficient way.

Fee analyzer

With Empower’s retirement fee analyzer tool, you can see how your retirement account fees are impacting saving for retirement and the eventual date. This analyzer factors in factor in typical retirement age, expected annual future contributions from you and your employer, selected risk tolerance, and return on investment based on historical trends and fund administrative and advice fees, some of which are personalized to funds you already personally selected.

From this assortment of data, Empower calculates estimated annual contributions, earnings and the effect fees may have on your total return over time so you can easily see what you would have in retirement before and after fees.

This tool may also show you any hidden fees in your mutual funds and point out opportunities to save on fees.

Cash management

Empower Personal Cash™ is a fee-free cash management account that earns a competitive interest rate. It doesn’t require a minimum balance and currently pays a notable 4.70% APY. Empower Personal Cash™ is covered with aggregate FDIC insurance up to $5 million/up to $10 million for joint accounts through their partner banks ($250K including principal & interest per depositor per program bank).

You can think of cash management accounts, including this one, as an alternative to traditional checking. It’s a safe place to store your cash until you’re ready to use it elsewhere and you can make withdrawals like a checking account. There’s no limits on the number of deposits or withdrawals you can make under the program and you can direct deposit your paycheck for easy funding. You can deposit $250,000/day and withdraw $25,000/day (up to $100K if you meet requirement).

This account lacks bill pay features found in many top checking accounts but is otherwise a good option whether you have an account with Empower or not.

How much does Empower cost?

Since Empowers service is made up of a variety of different tools and features, let’s go over pricing information for these individually.

Free app

Signing up for Empower app to use the calculators and powerful tools broken down above is free because the company hopes to connect at least a small percentage of users with paid wealth management service. The retirement planner is free. The net worth and cash flow tracking tool is free. The portfolio analysis is free. So are the number of awesome calculators!

The catch? If you have over $100,000 in assets, you’ll likely get a call from a financial advisor offering some friendly advice, but make no mistake, it’s a sales pitch. You may be open to it, though.

Paid wealth management

As far as financial advice goes, Empower is taking the right approach. Their financial planning services are fee-only, meaning they won’t try to sell you expensive investments hidden with commissions and fees.

Rather, you pay an annual fee based on the size of your investment portfolio to have access to a team of financial advisors who will provide investment management and other financial planning services.

Investors pay 0.89% a year on their $1 million of assets under management (AOM), then it slides down. Here’s the full schedule:

- 0.89% on the first $1 million

For private clients who invest $1 million or more:

- 0.79% on the first $3 million

- 0.69% on the next $2 million

- 0.59% on the next $5 million

- 0.49% over $10 million

Empower’s fee schedule is in line with industry norms, if a little less, but you may be able to find lower fees elsewhere.

Empower investment methodology

Empower is very open about its sound approach investment Personal Strategy® based on technology and the power of people to increase transparency with personalized advice from an advisor.

The strategy is built upon sector and style weighting, tax optimization and minimizing risk. Empower builds you a personalized portfolio with a team of advisors to execute it based on the unique situations and goals you provide them.

The strategy for its paid wealth management service is based on five principles:

Dynamic portfolio allocation

Because Empower is provided your total financial picture, they’re more easily to provide an efficient allocation and recommend adjustments as needed depending on your situation.

Personalization

The approach from Empower is tailored to unique situations and goals. They take that into account when coming together to create a plan based on your preferences and current financial stage.

Smart Weighting

This is a weighting to limit exposure to one sector or style, protecting against downside risk when a particular market or segment declines.

Tax optimization

Tax optimization is a big part of Empower’s investment strategy. It involves utilizing credits or deductions that can be used to reduce taxes. This is broken down into three key areas.

- Tax-sensitive asset location: If you’re an investor who holds both a taxable and tax-advantaged retirement account, tax-sensitive asset location ranks investments based on each investment type to have them placed in their most tax-efficient account types.

- Tax-loss harvesting: This is intentionally selling securities at a loss to turn a current unrealized loss into a realized loss, potentially saving money and improving an after-tax return.

- Tax efficiency: When it comes to investing, there are a lot of investment vehicles to choose from. Each choice can have different tax implications, so understanding which are the most efficient and provide the most control, like individual stocks and tax-efficient ETFs over mutual funds, can help reduce your taxes.

Rebalancing

Rebalancing consistently can help you remain well-diversified portfolio and enhance value over time, selling high and buying low as opportunities are presented.

My experience using Empower

Impressive app

For the most part, I’ve found the Empower user experience to be a good one. I’ve done most of my exploring on my laptop because the richness of their graphical reports lends itself to a bigger than four-inch screen. As a result, their iOS app on my iPad is also visually slick and easy-to-use.

Good security

Like any app that has access to sensitive financial information, security is important. Empower has two-factor authentication, meaning that whenever you log in from an unknown device (or clear your cookies), you’ll be required to get a text message or phone call with a PIN that you must enter along with your password.

That can be an inconvenient extra step at times but provides peace of mind that somebody who happens to swipe your login can’t view your entire financial picture.

How to get started with Empower

To sign up for Empower, you’ll need to link one or more of your bank and investment accounts (for example, your checking account, IRA with Fidelity, and 401(k) accounts). This process takes 10 minutes or so, and you’ll need to have the logins to those accounts handy.

With your account set up, you can access all of the free financial tools, including tracking of your portfolio.

The competition

Empower is a unique personal finance product and one of our most recommended for budgeting and portfolio tracking, but it’s not the only platform with planning tools or that can act as a robo-advisor.

Empower vs Wealthfront

Wealthfront is a robo-advisor that uses technology instead of humans to help you invest. Wealthfront charges an annual advisory fee of just 0.25% and lets you start investing with just $500.

Wealthfront is designed for young professionals, anyone from passive investors who want expert digital guidance, to people who want to be smarter with money.

With low fees and multiple tax perks, automated investment management tuned in to your individual risk level make Wealthfront worth a look.

- Passive investing with automated management

- Tax-loss harvesting

- Ability to customize portfolios

- No fractional shares of ETFs in automated accounts

- No human advisors

To get started, you’ll choose from a handful of curated portfolios and customize one for your desired asset allocation and risk tolerance. Then Wealthfront will automatically rebalance your portfolio and use tax-loss harvesting strategies, similar to those Empower recommends, to help you save.

If you prefer a more hands-off passive investing style, Wealthfront is probably going to be a better fit for your needs. This is also a good alternative to Empower if you don’t want to pay Empower’s higher fees or don’t have as much cash to deposit for their paid wealth management service. But Empower offers many more comprehensive money management features and financial tools with their 100% free app while Wealthfront is primarily a robo-advisor.

» MORE: Sign up for Wealthfront or read our full Wealthfront review.

Empower vs Betterment

Like Wealthfront, Betterment is a robo-advisor. But like Empower, it’s also a financial advisory firm.

Like Wealthfront, Betterment is a robo-advisor. But like Empower, it’s also a financial advisory firm.

Betterment is an all-in-one money management tool with dashboard that can help you track your net worth, analyze your cash flow, check your investments, and even plan for retirement. In addition to these free features, Betterment also offers paid robo-advisory services that will build and manage a portfolio for you.

Betterment’s basic investing features start at $4 month or 0.25% annually, but there’s also Betterment Premium, matching more what Empower offers. This provides on-demand guidance from their team of Certified Financial Planner™ and a personalized plan.

Betterment falls somewhere in between Empower and Wealthfront in terms of what is offered and how active you need to be as an investor/user.

» MORE: Read our full Betterment review.

Summary

The free and powerful tools from Empower, highlighted by a portfolio analysis tool, are a must-try for anyone looking to better understand their holdings and financial profile.

Over the years, I’ve used and tested dozens of different personal finance apps, but most lose their novelty after a while. I keep coming back to Empower because it’s the one product I’ve found that gives me insight into my entire investment portfolio, which is spread across several different brokers. The net worth dashboard makes it easy to see how your wealth is changing and if you’re meeting your investing goals.

Paired with the many other features Empower offers, they truly are the top financial product for many young and experienced investors alike.