Battling it out for top commercial space, I’m betting you’ve seen ads for all the big-name auto insurers. Besides thinking the Morgan Freeman look-alike is more entertaining to watch than Flo and her team, how do you decide which car insurance company actually offers the best features for your specific needs? Chances are, if you’re reading this review, you’ve been asking yourself that very same question.

Well, today I’ll try to help put the battle to rest, at least when it comes to Liberty Mutual. After all, they offer a lot more than Emus and a funny guy named Doug. With discount after discount, claims that are actually easy to file, and much more, Liberty Mutual gives other big-name companies a run for their money.

Liberty Mutual is an insurance company that has been around for over 100 years and has consistently marketed themselves as an insurer that really cares. In fact, one of their main slogans is: “we believe insurance should ease your concerns, not cause them.”

Liberty Mutual offers a big selection of policies, including home, renters, auto, life (term and whole life), flood, business, accident, and pet insurance.

- Lots and lots of discounts

- Make a claim in minutes

- Fast quotes

- Not the best customer service reviews

- Not all coverage is available in every state

What is Liberty Mutual?

Liberty Mutual is an insurance company that has been around for over 100 years and has consistently marketed themselves as an insurer that really cares. In fact, one of their main slogans is:

“we believe insurance should ease your concerns, not cause them.”

Their easy-to-use website and quote service make this statement appear to be true, but so does their history. Founded way back in 1912, Liberty Mutual’s first goal was to provide workers compensation insurance. Now they offer everything from auto insurance (which is what I’ll focus on today) to homeowners and renters insurance.

Overall, Liberty Mutual has really made a name for themselves when it comes to relatively low rates, steep discounts, and dedication to their serviced communities.

How does Liberty Mutual work?

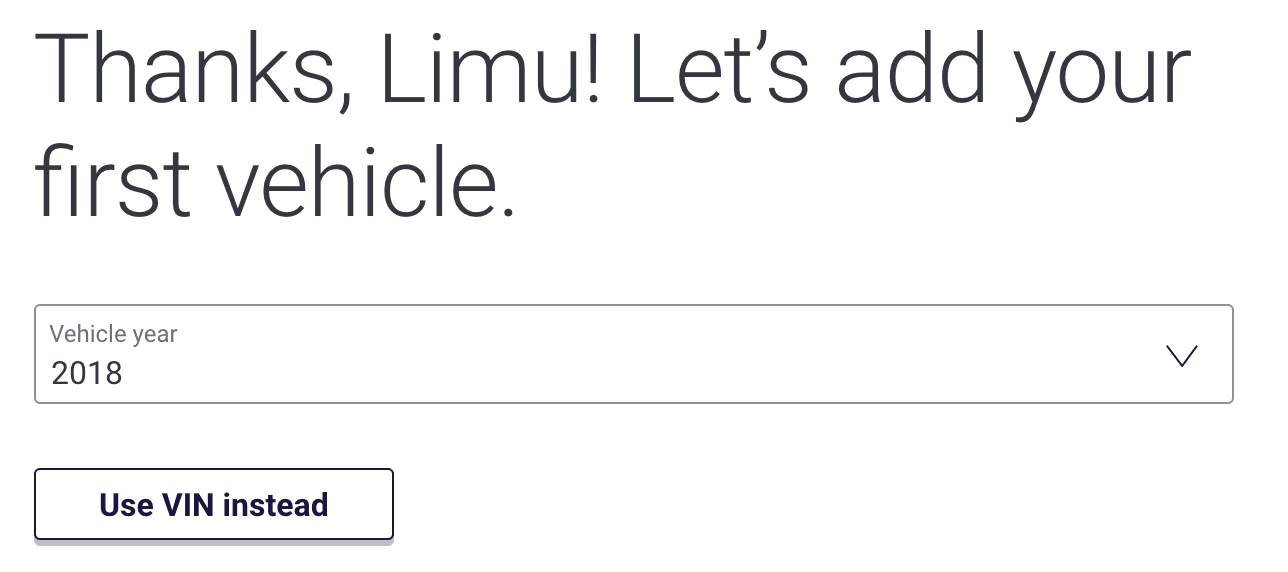

Getting a quote through Liberty Mutual is simple, but you will want to carve out as much as ten minutes of your time to do so. Start by heading over to the Liberty Mutual website and choosing the type of insurance that you are looking for. (In this case, auto). After you make your selection, enter your zip code and select “Get my price.”

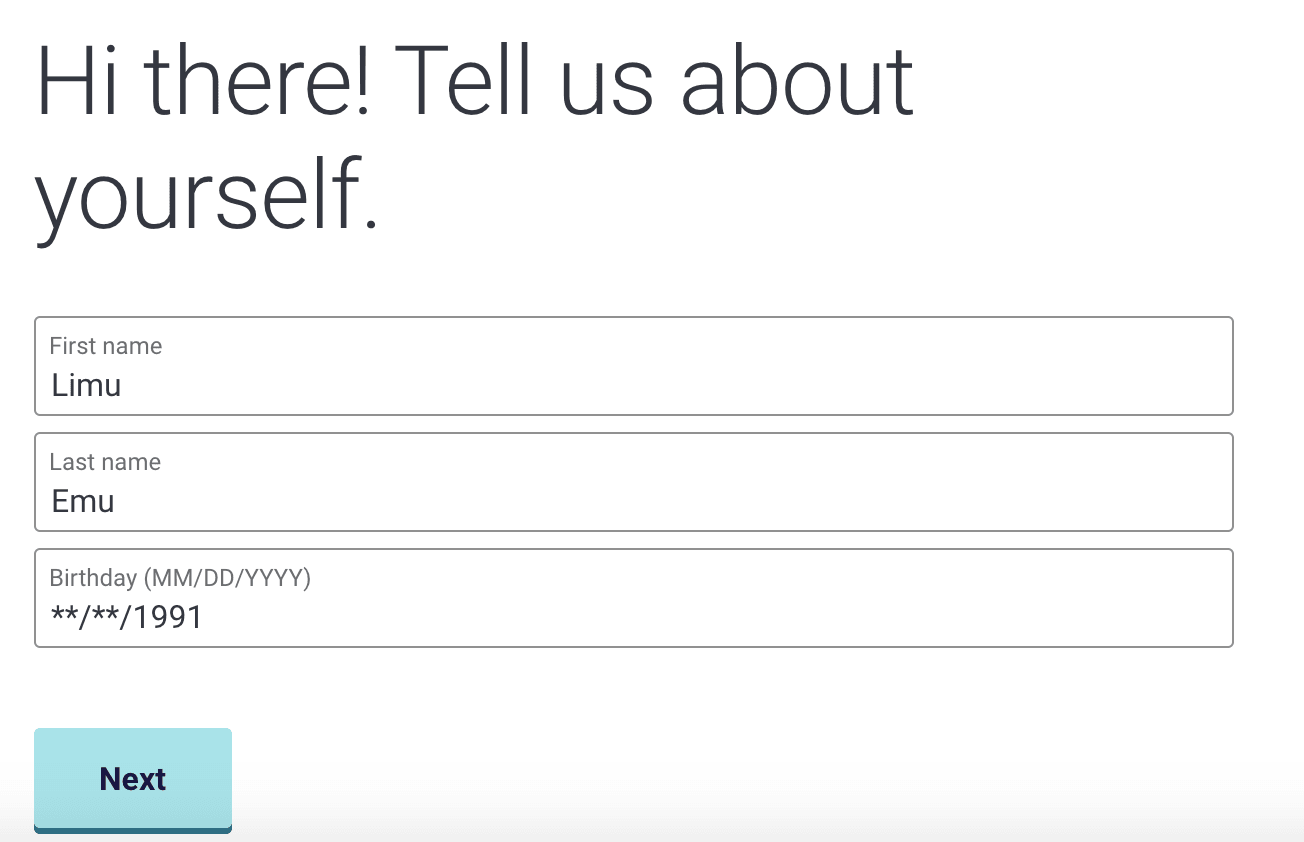

You’ll be led to the next screen, where you’ll be asked for your first name, last name, and birthday.

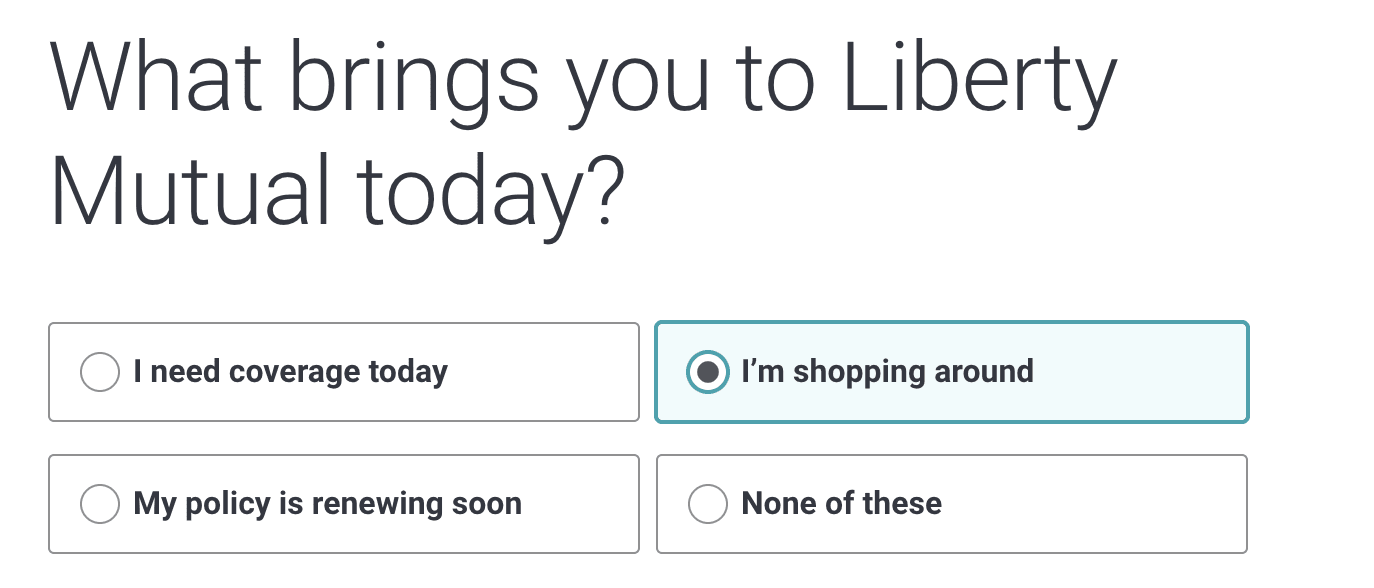

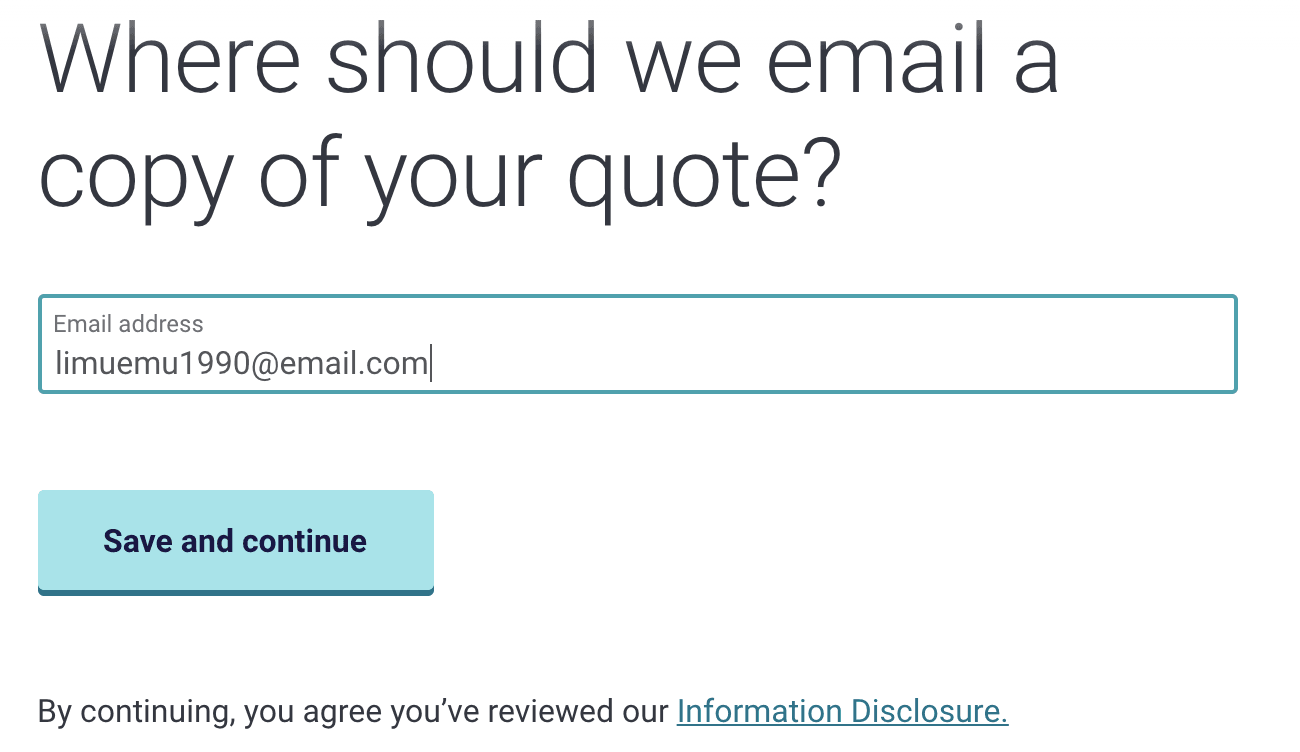

After Liberty Mutual learns your name, you will be asked to supply answers to a number of different questions about yourself, all of which help Liberty Mutual calculate your quote. You can expect to be asked for your address and to answer whether or not you have lived there for more than three months. As you click through, you’ll be asked why you’re stopping by Liberty Mutual’s site, as well as where a copy of your quote can be e-mailed to.

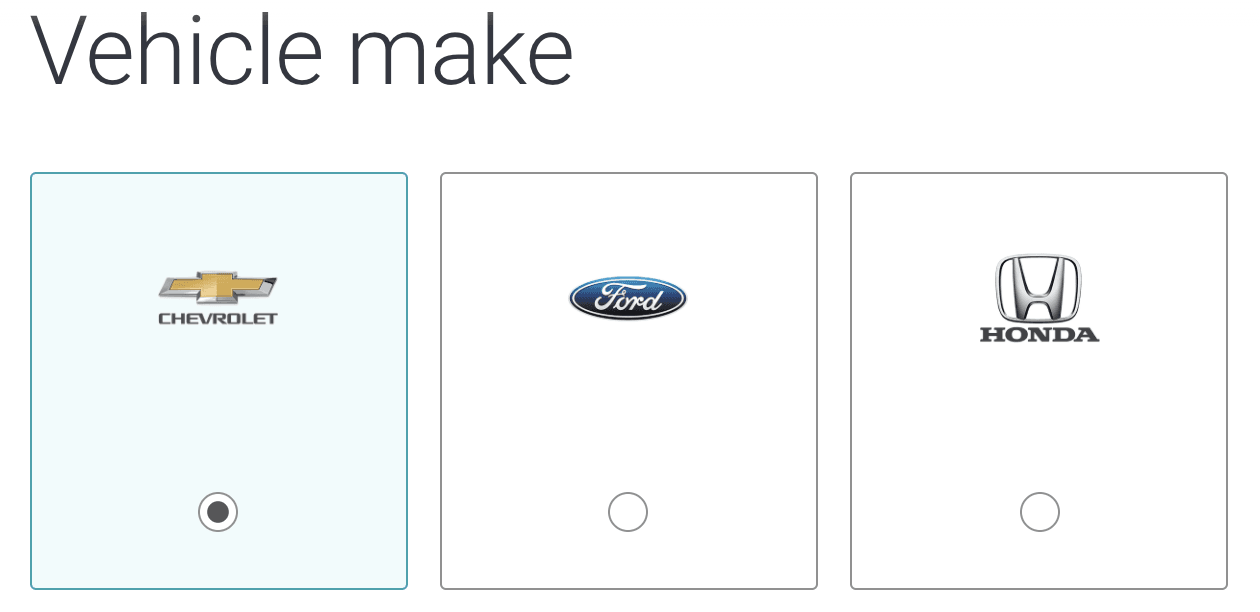

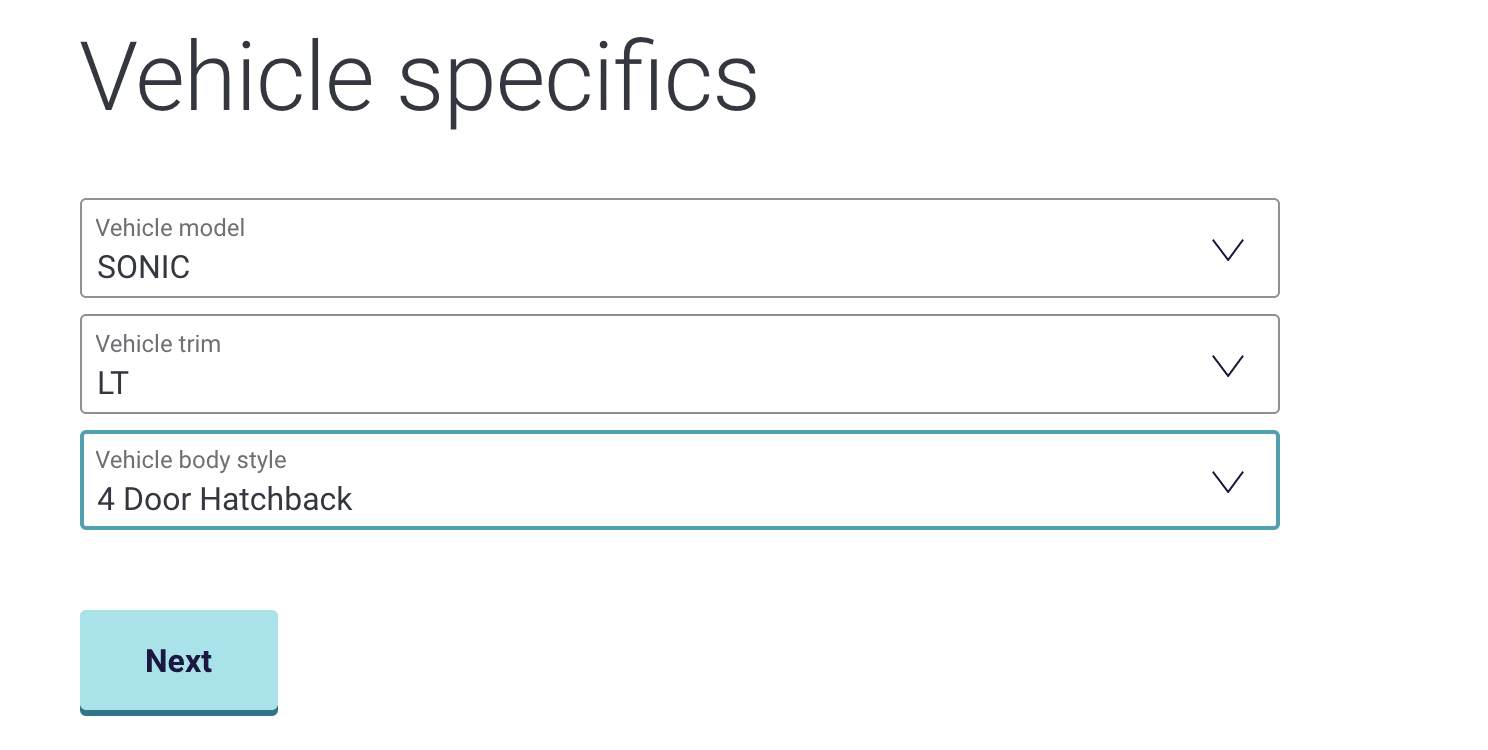

Once you’ve helped Liberty Mutual get to know you, they’ll want to learn more about the car (or cars) that you wish to insure. To do this, you’ll need to provide the year and make of your vehicle, plus the model and trim package. Alternatively, you can enter your vehicle’s VIN, which will autofill your info.

Next, you will be asked:

- If you own, finance, or lease your car.

- If you keep your car at the address you provided.

- What year you bought your vehicle.

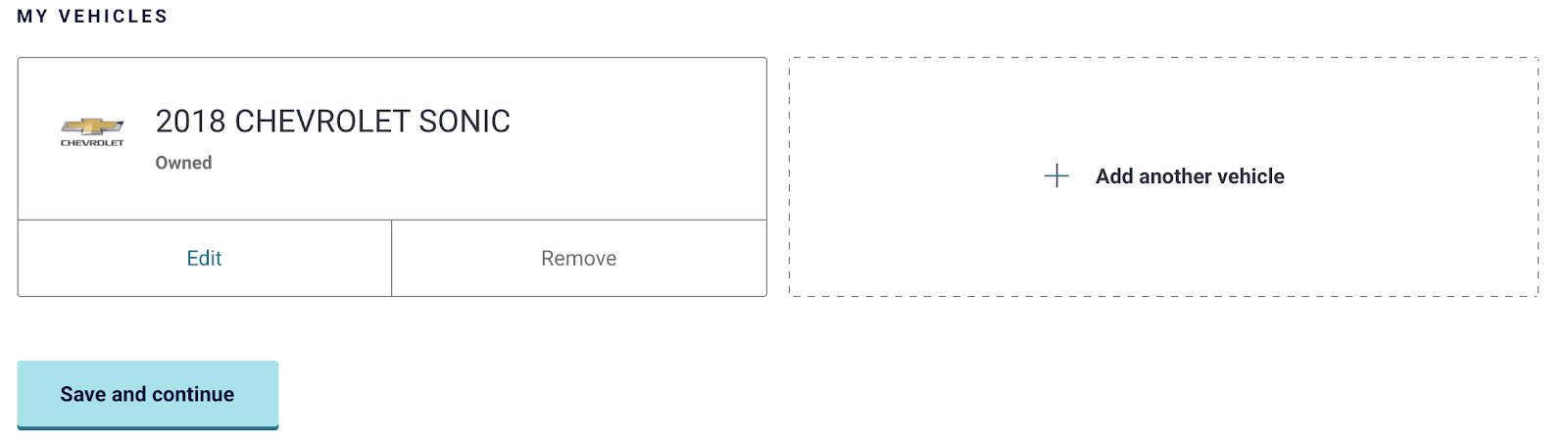

If this is the only vehicle that you are looking to insure, you can go on to the next step by hitting “Save and continue”. If you have another car to insure simply select “Add another vehicle”.

Once Liberty Mutual has a good understanding of the vehicle(s) that you would like to insure, they will want to get to know more about you. In order to accomplish this, you’ll be asked a series of questions, including:

- Are you married or in a civil union?

- What is your gender?

- How old were you when you got your license?

- What’s your phone number?

If you want to add another driver to your quote, you can do so now. Just like adding another vehicle, you will be given the option of “Adding another driver” once you complete the questions about yourself.

Now that Liberty Mutual has collected your information, there are just a couple more steps until you receive a quote, so hold tight!

To start, you’ll need to let Liberty Mutual know if you have any other policies with them. After that, you’ll be asked about your employment status, the highest level of education you have completed, and whether or not you own your home. Answering these questions helps Liberty Mutual find the right discounts for you! For example, when running a quote for myself, I qualified to save up to 30% by signing up for Liberty Mutual’s RightTrack®.

At this point, all that is left to do is let Liberty Mutual know about who you currently have an insurance policy through. In order to answer these questions precisely (which I recommend if you are in search of an accurate quote) you will need to know the following:

- If you currently have auto insurance or not.

- When you first signed up for auto insurance through your current insurer.

- Your current Bodily Injury Limit coverage amount.

- When you would like your policy to start.

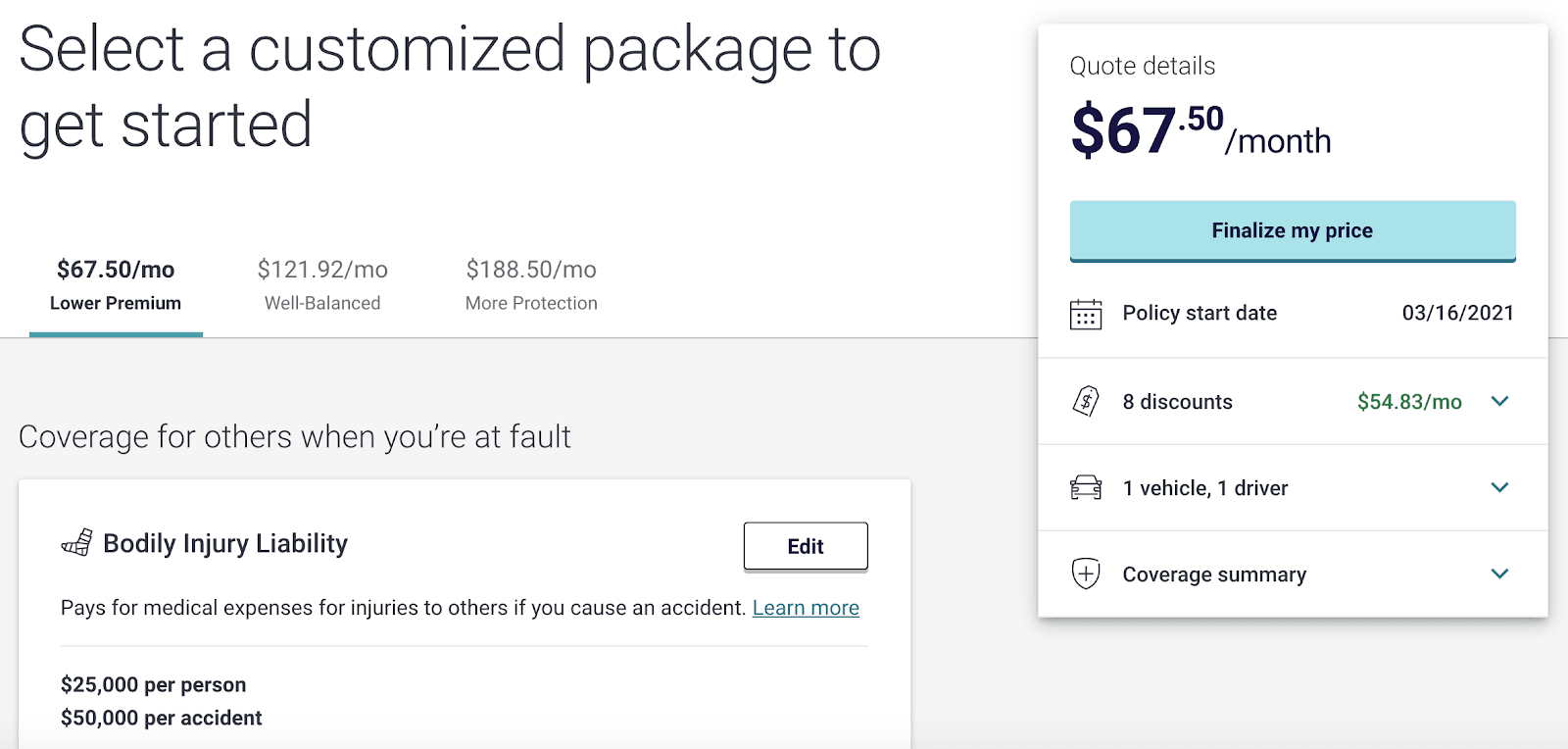

Once you are done and have hit “Save and continue” for the last time, Liberty Mutual will generate your quote! In order to review Liberty Mutual fairly, I ran my own quote. Here is what Liberty Mutual offered me:

How much does Liberty Mutual cost?

The price of your auto insurance will differ based on many different factors, including your age, driving record, and vehicle. This is exactly why my rates will be different than your rates.

One important factor to consider when getting a quote from any auto insurance company, and Liberty Mutual especially, is the discounts you’ll qualify for. This is what’s going to drive down your rates and qualify you for cheaper auto insurance. Never gotten into an accident? You’ll get a discount for that! Want to bundle home and auto? Discount. Drive less? Discount. You get the picture here.

To find out your rate, I recommend completing the quote process for yourself. When doing so, I also suggest that you take the time to answer all of the questions you are asked to the best of your ability. Although they may seem insignificant, even the most minor inaccuracy could make a huge difference in your quote.

Liberty Mutual features

Many discount options

You’ll notice Liberty Mutual’s impressive discount options the minute you get to their homepage.

Their front-page offer of a discount of 12% or more when you get your insurance quote online is just the beginning! Here are just a few other discounts Liberty Mutual offers:

- Bundling discounts.

- Military discount.

- Good Student discount.

- Student-Away-at-School discount.

- Alternative Energy discount.

- Accident-free discount.

- Multi-policy discount.

- Multi-car discount.

- Pay-in-Full discount.

- Online Purchase discount.

Whether you’re a student, someone with an impeccable driving record, or a military member, Liberty Mutual has a discount for you. To explore all of the discount options available for their auto insurance policies, head over to Liberty Mutual’s website and visit their “car insurance” page.

Easily make a claim

Filing a claim with Liberty Mutual is a breeze. You can file online any day of the week and any time, day or night. The process takes a grand total of 10 minutes, and you can track your claim’s progress via the mobile app.

ByMile offers a pay-per-mile option

If you live in a city with great public transportation or are a bit of a homebody like me, you may find that you don’t drive all that often. If not, you may find that auto insurance rates are unnecessarily steep for your risk level and, frankly, too damn high. This is where Liberty Mutual’s ByMile steps up to answer your call for lower car insurance.

ByMile is a small device that tracks your mileage and only charges you based on how many miles you drive per month. And if you want to go on a road trip, don’t worry about an outrageous bill. You’ll only be charged for the first 150 miles that you drive on a given day.

Coverage calculator

Liberty Mutual’s car insurance coverage calculator offers a convenient way to find out just how much auto insurance you really need. All you have to do is answer a couple of quick questions, like whether you own or finance your car, and then customize your coverage.

When customizing your coverage, you have the option of choosing whether or not you want features like roadside assistance and protection from uninsured drivers covered in your policy. Once you help Liberty Mutual understand what is important to you, they will let you know exactly what products they suggest to get you there.

RightTrack® safe driver program

Are you a safe driver? If you are, you could save up to 30% with Liberty Mutual’s RightTrack® safe driver program. In fact, you are guaranteed a discount just for trying it out! RightTrack® pays attention to your total miles driven, nighttime driving habits, braking, and acceleration.

Depending on your state, the way that RightTrack® tracks your driving habits will differ. In some states, you will be sent a small tag that you place on your windshield or, in others, a device that plugs into your vehicle’s OBD port. Depending on where you live, you may be able to simply download the RightTrack app directly onto your smartphone.

24/7 roadside assistance

One of my favorite features that Liberty Mutual offers is roadside assistance. If you have ever been stuck on the side of the highway with a broken-down car and no one reliable to help you get back on the road, you will know why.

Liberty Mutual’s roadside assistance is available to those enrolled 24/7 and covers:

- Towing to the closest qualifying facility.

- Jump starting.

- Delivering emergency fuel.

- Changing flat tires.

- Unlocking locked vehicle doors.

In order to take advantage of Liberty Mutual’s roadside assistance, you must have selected the “Towing & Labor Coverage” option when signing up for your policy.

Community give-back programs

If giving back to your community is important to you, you’ll be happy to know that Liberty Mutual holds the same value. Through their community give-back programs, in 2019 alone, they gave back over $45 million.

Liberty Mutual focuses their philanthropy in three different areas: homelessness, accessibility, and education. They even have a team of “Liberty Torchbearers”, which is made up of employees that serve, give, and volunteer within their communities. And it isn’t a small team! In 2019, 75% of their employees took part in the program.

Not so great customer service reviews

While you’ll find superb discounts and you’ll be impressed by the number of coverage options, one place Liberty Mutual lacks is in its customer service. With an unimpressive 1.09 stars out of 5 and over 1,000 complaints, Liberty Mutual can’t compete with the competitors in this field.

However, if you’re happy taking care of things yourself in Liberty Mutual’s well-designed mobile app, then Liberty Mutual will likely still be a good fit for you.

My experience researching Liberty Mutual

What first struck me about Liberty Mutual, when researching them for this review, was how many options that they make available to their policyholders. Not only do they offer an impressive list of discounts, but they offer pay-per-mile insurance coverage, 24/7 roadside assistance, a simple claims process, and even a safe driving program that rewards you for being a savvy driver. These options make it obvious that Liberty Mutual is committed to not only serving as many drivers as possible but truly caring for their needs.

That said, on the other side of the coin, what I found most disappointing about Liberty Mutual is their less than perfect customer service reviews. As someone who truly appreciates an efficient and helpful customer service line, this could become an issue if I were to pursue a policy with Liberty Mutual.

Overall, it is clear to me that Liberty Mutual is a household name for a reason. They offer high-quality policies to people across the entire country for fair premiums. For many, this is more than worth a few customer service shortcomings.

Who is Liberty Mutual best for?

Good drivers who qualify for discounts

As with most insurance companies, Liberty Mutual will work best for those who qualify for their discounts, which will significantly lower your rates. Luckily, Liberty Mutual has a ton of discount options. But, customers who will be rewarded the most are the violation-free, safe drivers.

Low mileage drivers

Low mileage drivers are usually stuck paying the same rates as high mileage drivers, but not at Liberty Mutual. If you don’t drive all that often, or all that far, you will love saving with their ByMile insurance option.

Those who prefer an online experience

Liberty Mutual has spent a lot of time perfecting their online experience. Getting a quote is a thorough, yet easy process, and making a claim takes minutes and you can do it from the comfort of your own couch at any time on a smartphone.

Who shouldn’t use Liberty Mutual?

Those looking for the lowest rates possible

While Liberty Mutual offers some competitive rates, they’re not the lowest around. But their large numbers of options and great user experience may make up for this in the long-run.

Those with an accident or two on their record

If you’ve had a number of accidents or driving violations, unfortunately, you won’t be able to qualify for a large number of Liberty Mutual’s discounts.

Drivers looking for top-notch customer service

With low customer service ratings, Liberty Mutual may not be for you if you value an old-school insurance experience that involves speaking with customer service frequently. You’ll feel more at home with Liberty Mutual if you prefer a do-it-yourself method.

Pros & cons

Pros

- Lots and lots of discounts — Liberty Mutual offers a large number of discounts, such as Multi-policy discounts, Pay-in-Full discounts, and many more.

- Make a claim in minutes — Making a claim takes just 10 minutes, and you can file online 24/7.

- Fast quotes — You’ll get a quote within minutes with Liberty Mutual’s easy-to-understand application.

- Pay-per-mile option — If you don’t drive a ton, you’ll appreciate that Liberty Mutual’s ByMile program only charges you based on how many miles you drive each month.

- A company who cares — Progressive not only rewards loyalty, but they focus on giving back to their communities as a whole.

Cons

- Not the best customer service reviews — According to the BBB, Liberty Mutual has one weak spot: customer service. With a 1.09 rating, you may want to look elsewhere if you value responsive customer service.

- Not all coverage is available in every state — For example, Accident Forgiveness is not available to residents of California.

Liberty Mutual vs. competitors

| Liberty Mutual | Progressive | |

|---|---|---|

| Discount options | Military, Multi-policy, Homeowner, Good Student, Alternative Energy, Accident-free, Pay-in-Full, and more | Multi-policy, Multi-car, Teen Driver, Good Student, Homeowner, Online quote, Distant Student, and more |

| Auto coverage types | Collision, Comprehensive, Medical Payments, Uninsured Motorist, Personal Injury Protection, Body Injury Liability, Property Damage, Car Replacement | Liability, Comprehensive, Collision, Uninsured Motorist, Medical Payments, Rental Car Reimbursement, Roadside Assistance |

| Other insurance products offered | Home, Renters, Life, Motorcycle, Boat, Condo, Landlord, Flood, Identity Theft, and more | Home, Condo, Flood, Renters, Mobile home, Boat, Motorcycle, RV, Life, Pet, and more |

Progressive

Progressive is one of Liberty Mutual’s biggest competitors and is definitely a worthy challenger. They offer tons of coverage options, as well as a substantial number of other insurance products (which you can bundle and get a discount!).

Progressive is one of Liberty Mutual’s biggest competitors and is definitely a worthy challenger. They offer tons of coverage options, as well as a substantial number of other insurance products (which you can bundle and get a discount!).

But where Progressive really shines is in its loyalty to customers. In fact, the second you become a Progressive customer, you’re automatically enrolled in their loyalty program. The program offers immediate rewards such as Small Accident Forgiveness.

Summary

Liberty Mutual sets itself apart in a few different ways. For one, they focus on low rates, which is obvious by their extensive number of discounts. Plus, when you go with Liberty Mutual, you’ll be going with a company that values their community and that has openly given back in an effort to make your community a better place.

While you’ll have to forgive some spotty customer service, you’ll easily find a lot of perks if you opt to protect your vehicle with Liberty Mutual.