Sometimes it feels like you’ll never pay off that big loan, particularly if you’re making puny monthly payments and crawling toward the finish line. But speeding the repayment process up is easier than you might think, and it’s surprising how much you can save in interest by paying off your loan just a bit faster.

Our loan payoff calculator lets you test out different loan repayment scenarios to see just how fast you can eighty-six your debt.

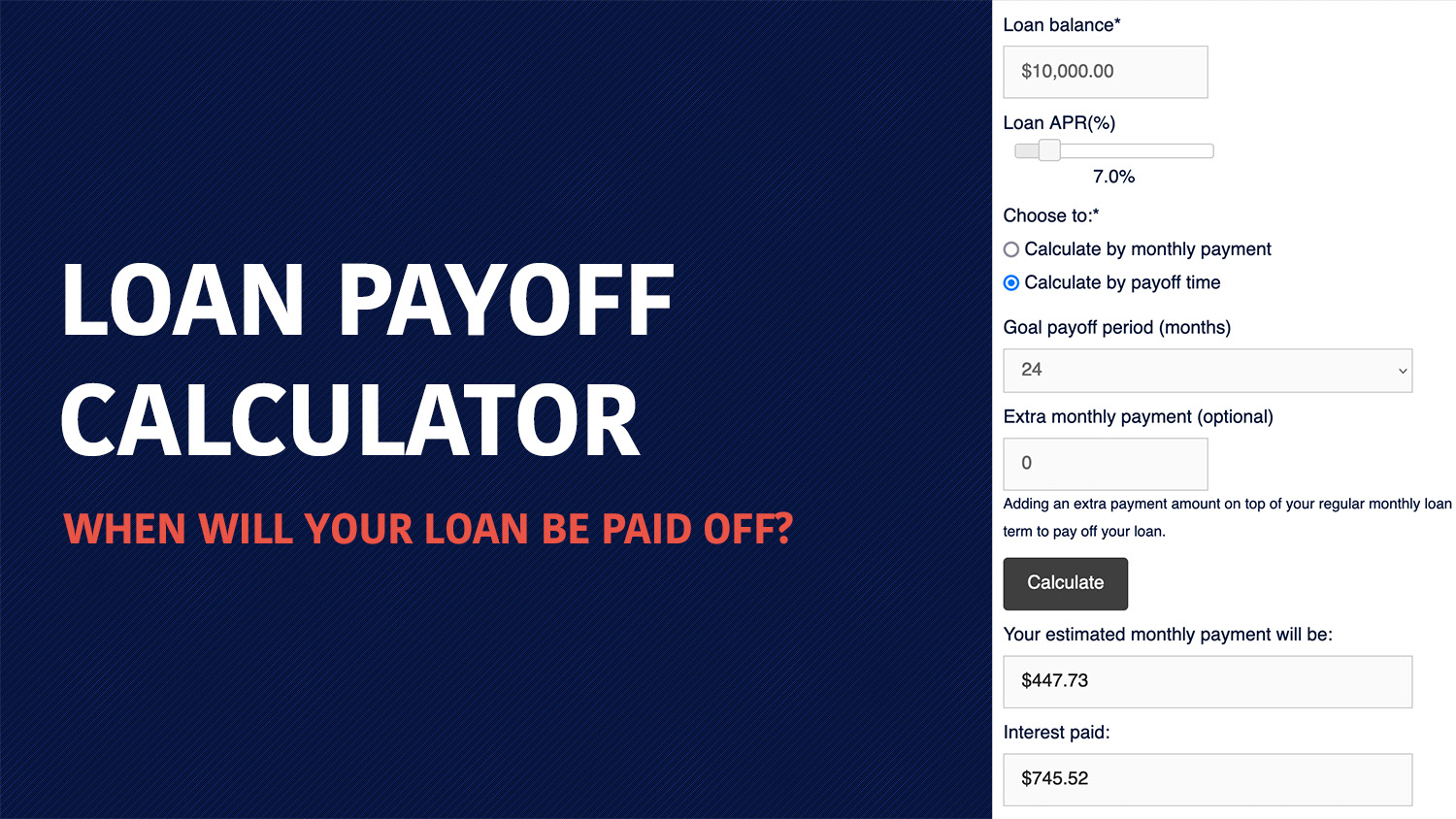

Loan payoff calculator

If you’re shopping for a loan or looking to refinance existing debt, read more about how and where to find the the best personal loans for your needs.

How the loan payoff calculator works

To use the Loan Payoff Calculator, you’ll start by entering two critical pieces of information: the remaining loan balance and the APR (interest rate) you’ll be paying.

From there, you’ll have the option to calculate by monthly payment or calculate by payoff time. Click the bubble next to the one you want to tinker with first.

Let’s take a look at each.

Calculate by monthly payment

You can use this option to find out what will happen if you increase or decrease the amount you repay on your loan each month.

For this example, start with the default loan amount of $10,000 and APR of 7%.

Next, select calculate by monthly payment. You’ll be asked to enter your expected monthly payment. Let’s enter $155. Then hit the calculate button.

The Loan Payoff Calculator will display three results:

- Months to payoff: 81 months, in this case

- Years to payoff: 6.75 years

- Interest paid: $2,555

Notice that this relatively low, $155 monthly payment results in a very high amount of interest paid over the life of the loan. $2,555 is over 25% of the $10k loan principal!

In this case, let’s say you make a decision to cut back on some monthly recreational spending and allocate more of your earnings toward repaying your loan.

By increasing your monthly loan payment to $255, your payoff numbers start to look dramatically different:

- It will take you only 45 months to pay the loan off — three years less than the $155 monthly payment plan.

- You’ll pay only $1,475 in interest during that time. That’s a savings of over $1k.

Calculate by payoff time

If your goal is to repay your loan by a certain date, you can instead input that timeframe to find out what monthly payment amount you’ll need to make to get there, and how much the adjusted finish line will save you in interest paid.

To do this, select calculate by payoff time. Your goal payoff period can be adjusted in 12-month increments.

You can also enter any extra monthly, one-time payment amount you plan to make in addition to your regular monthly payments. Just leave that blank if you plan to make your monthly payments only.

For this example, let’s enter a fairly aggressive 36 months for the goal payoff period on that same $10,000 loan at 7% APR. Then hit the calculate button.

The Loan Payoff Calculator will display two results:

- Monthly payment: $308.77

- Interest paid: $1,115.72

You can also use this calculator before you take out a new loan, to see how your potential loan terms could play out.

If you’re in the market for a loan, check out our list of the best personal loans, and then use the Loan Payoff Calculator to see how your repayment plan could stack up.

Summary

Using our Loan Payoff Calculator might just give you that extra injection of motivation you need to pay off your loan faster and save a heap of dough in the process.

Play around with different monthly repayment amounts or repayment time frames to find a match that will work with your budget. Then contact your lender to see if your loan includes any clauses against early repayment. If it does, check the prepayment penalty against what you would save in interest by early payoff.

Need a lower rate? Learn how to find the best personal loan rate available to you with no impact on your credit score.