Over the past couple of weeks, I’ve laid out three steps to help you build a hassle-free money management system:

- How to manage your spending without a traditional budget.

- How to create a bank account buffer™ to eliminate the risk of overdrafts.

- How to put your bills and savings on autopilot.

What I’ve written is incomplete, however, without one piece of the puzzle: an automatic investment plan.

Arguably, putting your investments on autopilot is the most important thing you can do for your finances.

If you don’t want to automate the rest of your finances—if you prefer to set aside a few hours a month to pay bills, transfer money to savings, and balance your checkbook, that’s fine. Some people will sacrifice time for that kind of control. But you should still consider setting up automated investments.

Investor and financial author Robert G. Allen sums up the biggest reason:

How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.

Many of us delay investing (or fail to start at all) because we’re either intimidated by choosing investments or we’re afraid of the risk. An automatic investment plan can help. One of the techniques I outline here requires zero investing knowledge to get started—it’s as easy as opening a bank account. And, when you put your investments on autopilot, you take your emotions out of investing, which can temper your fear—or at least limit fear’s ability to cost you money. Let’s look at how an automatic investment plan does this.

Dollar-cost averaging

The technique of buying a fixed amount of an investment at regular intervals is known as dollar-cost averaging (DCA). Lump-sum investing is when you put your amount right to work without waiting. You may be wondering: is DCA or lump-sum investing a better strategy?

If you were to invest $1,000, perhaps by buying in a mutual fund when it’s per-share price is $100, you would own 10 shares.

If, however, you invest $100 a month for ten months and the fund’s price varies from $80 to $120, you may end up slightly more or less than 10 shares depending on the stock prices. As the market climbs, the notion is you will end up buying more shares at a lower price than if you invested in a lump sum. Advocates of dollar cost averaging say this reduces risk, but critics disagree. The market goes up in the long run, so you want to get money in as soon as possible.

If you have a lump sum sitting around that you want to invest, then do it. Get it into the market and don’t worry about spreading it around and definitely don’t try to time the market or wait for the right time.

For the rest of us, an automatic investment plan makes sense for two reasons:

- It lets you invest on a regular schedule.

- It prevents self-sabotage.

Invest as you’re paid

Ask people who are successful at saving and building wealth and you’ll find that many of them have two things in common:

- They invest, rather than leaving all of their cash in a bank account.

- They pay themselves first.

I’ve recommended paying yourself first as a strategy for building cash savings for emergencies, and you can do the same thing with your investments.

Your employer may make this easy by offering a 401(k) or similar retirement plan to which you can contribute through automatic payroll deductions.

Otherwise, you can start a Roth IRA and begin making regular contributions on paydays in addition to cash you transfer to a savings account.

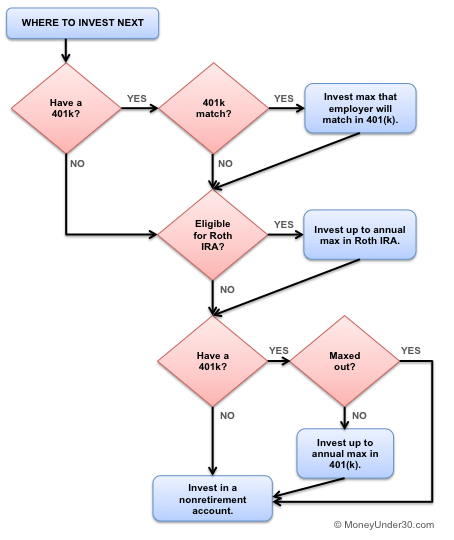

Are you already saving enough for emergencies and retirement? Then it’s time to open a non retirement investing account and put money away for “life”. Use this flowchart to help you decide how to allocate your investing dollars:

Prevent self sabotage

You can’t rely on willpower to reach your financial goals.

You may be able to hunker down and fight the urge to splurge at the mall or bet on a hot stock tip…for a while. But eventually your emotions will get the best of you. You’ll calm your nerves after a tough week with a spending spree. Or give into fear and postpone an investment during a volatile month in the market.

Carl Richards, author of The Behavior Gap, knows this, and in a recent New York Times blog post offers the same advice I’m giving now: Use automation prevent your emotions from influencing your financial decisions.

How to set up automatic investments

Nearly every mutual fund company and online stock brokerage make it easy to set up automatic investing in mutual funds, whether it’s in an IRA or non-retirement account. Most will waive minimum investment requirements when you enroll in an automatic investment plan.

This is how it works:

- You set up an automatic transfer from your bank account to your investment account (for example, on payday).

- You specify which mutual fund(s) to invest in and your money is automatically invested at the current price.

The key to keeping automatic investing affordable is to invest directly with a mutual fund company (for example, buy Vanguard funds through Vanguard or Fidelity funds through Fidelity) to avoid paying a trade commission each month. Alternatively, some robo-advisors, like M1 Finance let you automatically invest with no extra fees. With M1 Finance, you can also set up a monthly, bi-monthly or weekly schedule to deposit money to your account.

What about individual stocks?

Mutual funds make automated investing easy because you can invest any amount in a mutual fund regardless of the current price. (You can buy fractions of a share.)

In most cases, however, with individual stocks and exchange-traded-funds, you must purchase whole shares. So if you want to automatically invest $100 in ABC stock with a current price of $11, you can only buy nine shares and will have a $1 left over.

One way around this is with M1 Finance, a robo-advisor that also offers some of the flexibility of using a broker. M1 Finance’s entire model is built around automatic investing plans, and you can invest a fixed amount in individual stocks as well as mutual funds (you can hold fractional shares). M1 offers this service absolutely free, with no commission or management fees. It’s makes the list of one of our best robo-advisors.